here.

here.

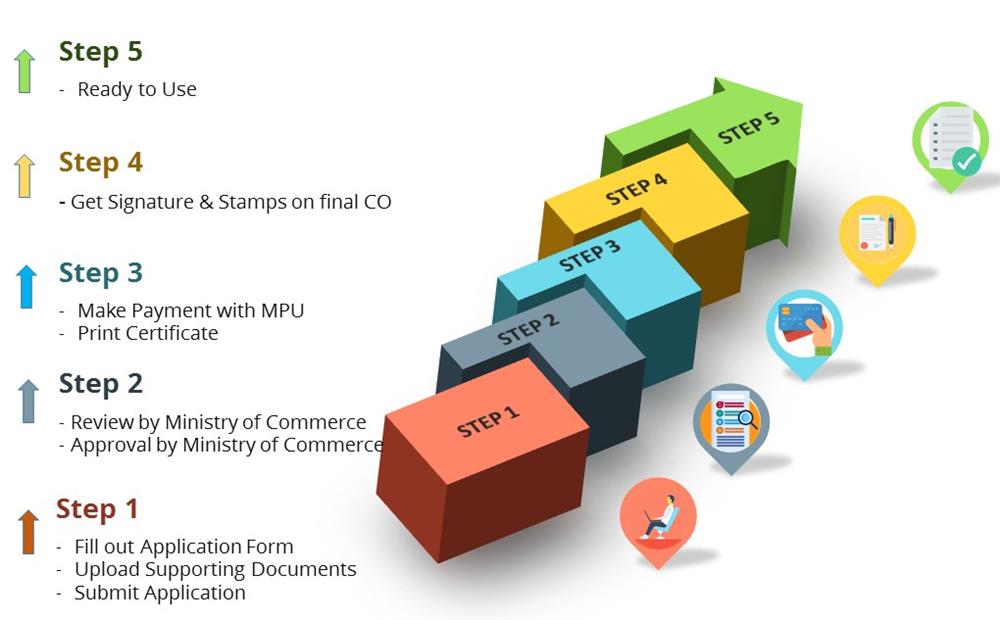

The general application steps for Certificates of Origin and for ATIGA Form D (wholly obtained products) are as follows:

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Product Photo

- 7. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Product Photo

- 7. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Product Photo

- 7. Product Photo

- 8. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Product Photo

- 7. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Product Photo

- 7. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Certificate of Product Registration

- 7. HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- 8. Production Process

- 9. Import Declaration for Input Materials/Document generated by MACCS System

- 10. Product Photo

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. (Not Wholly Obtained)

- Certificate of Product Registration

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Product Photo

- 7. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Product Photo

- 7. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Product Photo

- 6. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

- 1. Export Declaration/Document generated by MACCS System

- 2. Transport Documents/BL

- 3. Invoice

- 4. Packing List

- 5. Undertaking Letters

- 6. Product Photo

- 7. (Not Wholly Obtained)

- Cost Statement for(one unit)

- HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- Production Process

- Import Declaration for Input Materials/Document generated by MACCS System

here.

here.

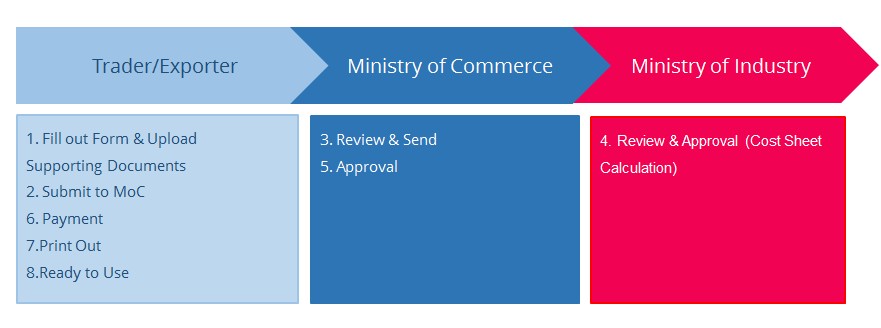

The general application steps for Product Registration Card (wholly obtained products) are as follows:

- 1. Invoice

- 2. Packing List

- 3. Cost Statement for(one unit)

- 4. HS Code (at 6 digit level) and Description of Input Materials and Finished Products

- 5. Production Process

- 6. Import Declaration for Input Materials/Document generated by MACCS System

- 7. Sale Contract

- 8. Industrial Registration

- 9. Product Photo

- 10. Letterhead for MOC

- 11. Letterhead for MOI

- 12. Other

here.

here.

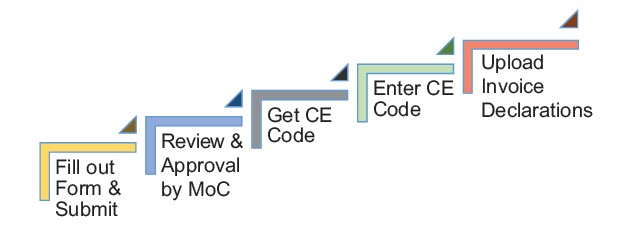

The application steps for ATIGA Certified Exporter are as follows:

- 1. Form XXVI Copy

- 2. Company Registration Copy

- 3. Undertaking Letter

- 4. Specimen Signature of Authorized Persons

The “Certified Exporter” scheme is a pilot project under the ASEAN Trade in Goods Agreement (ATIGA). Economic operators that have been certified by the Ministry of Commerce can self-certify the origin of their goods instead of applying for Certificate of Origin Form D. This self-certification scheme is intended to further facilitate intra-ASEAN trade.

Traders can apply for a Certified Exporter Code through this website and use the Code to scan and upload their invoice declarations electronically. This way, a personal visit to MoC to submit the hard copy documents is no longer required.

More information can be found at: